date at the 3.20 region before testing the all time high of 3.40 again, possibly setting another all-time high. RSI is showing gd strength, above the 50% mark, however upwards movement limited by the downward resistance rsi trendline. Look towards the last arrow on the right for estimated time period of a breakout.

date at the 3.20 region before testing the all time high of 3.40 again, possibly setting another all-time high. RSI is showing gd strength, above the 50% mark, however upwards movement limited by the downward resistance rsi trendline. Look towards the last arrow on the right for estimated time period of a breakout.

Welcome! Have a profitable trading day ahead of you!

Monday, July 31, 2006

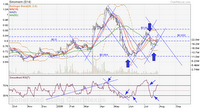

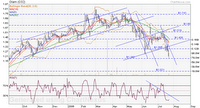

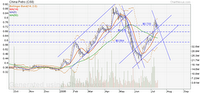

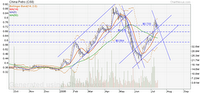

SembCorp Marine

Overwhelming requests for SembCorp Marine from the polls, so here it is, dedicated to all of you. Listed since 18 September 1987 on SGX Mainboard, SembCorp Marine Ltd provides marine engineering services such as ship repair, shipbuilding, ship conversion, rig building and offshore engineering. The Group has shipyards in Singapore, China, Indonesia and Brazil.

Refer to the price and rsi trendlines, SembMar is likely to consoli date at the 3.20 region before testing the all time high of 3.40 again, possibly setting another all-time high. RSI is showing gd strength, above the 50% mark, however upwards movement limited by the downward resistance rsi trendline. Look towards the last arrow on the right for estimated time period of a breakout.

date at the 3.20 region before testing the all time high of 3.40 again, possibly setting another all-time high. RSI is showing gd strength, above the 50% mark, however upwards movement limited by the downward resistance rsi trendline. Look towards the last arrow on the right for estimated time period of a breakout.

date at the 3.20 region before testing the all time high of 3.40 again, possibly setting another all-time high. RSI is showing gd strength, above the 50% mark, however upwards movement limited by the downward resistance rsi trendline. Look towards the last arrow on the right for estimated time period of a breakout.

date at the 3.20 region before testing the all time high of 3.40 again, possibly setting another all-time high. RSI is showing gd strength, above the 50% mark, however upwards movement limited by the downward resistance rsi trendline. Look towards the last arrow on the right for estimated time period of a breakout. Sunday, July 30, 2006

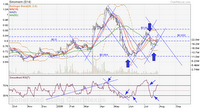

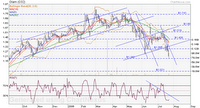

Global Testing

As requested by ysh02. Global Testing Corporation Limited provides testing services to the semiconductor industry such as wafersorting and final testing services. The Group's operations are in US and Taiwan and counts among its custo mers the world's leading foundries namely TSMC and UMC.

mers the world's leading foundries namely TSMC and UMC.

Technically, Global Testing is gathering momentum for an up move after breaking .25, next resistance at .275. Target at .29, the 61.8% retracement mark from high of .39 and low of .225.

mers the world's leading foundries namely TSMC and UMC.

mers the world's leading foundries namely TSMC and UMC.Technically, Global Testing is gathering momentum for an up move after breaking .25, next resistance at .275. Target at .29, the 61.8% retracement mark from high of .39 and low of .225.

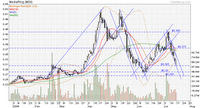

Sinomem

As requested by ateo. Listed since 18 June 2003 on SGX Mainboard, Sinomem Technology Ltd business focus is to provide customised process and engineering solutions through the use of advanced membrance technology to indu stries such as Pharmaceuticals, Chemical & Dyestuff, Food and Water & Wastewater treatment.

stries such as Pharmaceuticals, Chemical & Dyestuff, Food and Water & Wastewater treatment.

From chart, sinomem just broke out of the 61.8% retracement level at .83, from the high of 1.06 and low of .685. Next resistance at .89, likely consolidation between .83 and .86 region. Next support at .80.

stries such as Pharmaceuticals, Chemical & Dyestuff, Food and Water & Wastewater treatment.

stries such as Pharmaceuticals, Chemical & Dyestuff, Food and Water & Wastewater treatment.From chart, sinomem just broke out of the 61.8% retracement level at .83, from the high of 1.06 and low of .685. Next resistance at .89, likely consolidation between .83 and .86 region. Next support at .80.

Saturday, July 29, 2006

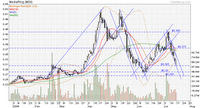

Jadason

As requested by sianzsianz. Jadason Enterprises Ltd supplies equipment and solutions to the printed circuit boards (PCB) and semiconductor i ndustries with operations spanning over Asia.

ndustries with operations spanning over Asia.

From the chart, it is likely to mvoe up and test the 61.8% retracement mark at .185, and subsequently the 31.8% retracement mark at .205. Recent good support at .155 followed by .135.

ndustries with operations spanning over Asia.

ndustries with operations spanning over Asia.From the chart, it is likely to mvoe up and test the 61.8% retracement mark at .185, and subsequently the 31.8% retracement mark at .205. Recent good support at .155 followed by .135.

Aztech

As requested by SH. Listed since 23 February 1994 on SGX Sesdaq, Aztech is a leading OEM/ODM manufacturer in data communication and personal communication products with customers in the Computer and Telecommunication Industries. I still vividly remember the excitement i had when i bought my very first sound card for my pc. No, it was not a SoundBlaster from Creative, it was an Aztech 8bit mono soundblaster-compatible soundcard from Aztech. Even then, i showed streaks of supporting the u nderdogs. ;)

nderdogs. ;)

nderdogs. ;)

nderdogs. ;)Technically, expect consolidation at the .23 level before testing .27, the 38.2% retracement mark from the high of .32 & low of .195. RSI turning down from the 70% overbought mark. One point worth mentioning on the overbought and oversold levels is that one shld not assume that stocks will immediately turn down once it hit the oversold level. The Relative Strength Index (RSI) is an extremely useful and popular momentum oscillator. The RSI compares the magnitude of a stock's recent gains to the magnitude of its recent losses. A stock can and do remain in the oversold or overbought level for extended period. It is only significant when the rsi starts to reversed from the 70% and 30% levels.

Friday, July 28, 2006

Want Want

As requested by tanahteck. Chances are u have tasted at least one type of crackers from Want Want during the Chinese New Year, as Want Want is a leading manufacturer of snack food and beverages, best renowned for its rice crackers.

Technically, Want Want has very nice chart patterns, by that i dont

mean its easy to make money out of it, what i meant was one could infer the recurring trendlines easily from its past chart formation. Important support lies on 1.22 and 1.31. Now, take this opportunity to go through my posted chart, and infer from the trendlines and arrows i have put in. Try to come out with what u think is happening. It will be very useful in your learning of TA. Any advances is likely to be capped at 1.40. As such, calculate your risk/reward ratio in relation to its current price, and the price that u are likely to unload, before u decide on trading it.

chart, and infer from the trendlines and arrows i have put in. Try to come out with what u think is happening. It will be very useful in your learning of TA. Any advances is likely to be capped at 1.40. As such, calculate your risk/reward ratio in relation to its current price, and the price that u are likely to unload, before u decide on trading it.

Technically, Want Want has very nice chart patterns, by that i dont

mean its easy to make money out of it, what i meant was one could infer the recurring trendlines easily from its past chart formation. Important support lies on 1.22 and 1.31. Now, take this opportunity to go through my posted

chart, and infer from the trendlines and arrows i have put in. Try to come out with what u think is happening. It will be very useful in your learning of TA. Any advances is likely to be capped at 1.40. As such, calculate your risk/reward ratio in relation to its current price, and the price that u are likely to unload, before u decide on trading it.

chart, and infer from the trendlines and arrows i have put in. Try to come out with what u think is happening. It will be very useful in your learning of TA. Any advances is likely to be capped at 1.40. As such, calculate your risk/reward ratio in relation to its current price, and the price that u are likely to unload, before u decide on trading it. Thursday, July 27, 2006

Tat Hong

As request by Janet. Tat Hong operates the largest fleet of cranes in the world with main operations in Asia and Australia. Most of the operation is the rental of cranes to companies in the oil and gas and infrastructure sectors as they find it more cost effective to rent from Tat Hong than to own the cranes and risk machine failures.

it more cost effective to rent from Tat Hong than to own the cranes and risk machine failures.

Technically, Tat Hong is a super stock, with very nice longterm upwards trendchannels. Recently reached bottom at .885, its current support is at .985. It look set to test and break resistance at 1.07 and resume its relentless climb.

it more cost effective to rent from Tat Hong than to own the cranes and risk machine failures.

it more cost effective to rent from Tat Hong than to own the cranes and risk machine failures. Technically, Tat Hong is a super stock, with very nice longterm upwards trendchannels. Recently reached bottom at .885, its current support is at .985. It look set to test and break resistance at 1.07 and resume its relentless climb.

Asia Environment

As requested by ChaiQi. Asia Environment is one of the other water-treatment specialist serving the growing China market. From the chart and rsi rea ding, it may go sideway with a downward bias before moving upwards. The blue arrow at the further right suggest the estimated time period that it has the chance to breakout from consolidation. Support at .265 and .245. Barring any negative events in China, buy on weakness above .245 with a short term trading target of .29.

ding, it may go sideway with a downward bias before moving upwards. The blue arrow at the further right suggest the estimated time period that it has the chance to breakout from consolidation. Support at .265 and .245. Barring any negative events in China, buy on weakness above .245 with a short term trading target of .29.

ding, it may go sideway with a downward bias before moving upwards. The blue arrow at the further right suggest the estimated time period that it has the chance to breakout from consolidation. Support at .265 and .245. Barring any negative events in China, buy on weakness above .245 with a short term trading target of .29.

ding, it may go sideway with a downward bias before moving upwards. The blue arrow at the further right suggest the estimated time period that it has the chance to breakout from consolidation. Support at .265 and .245. Barring any negative events in China, buy on weakness above .245 with a short term trading target of .29. Wednesday, July 26, 2006

Singtel

Investors of Singtel were largely taken by surprise in the leaving of long-serving CEO Lee Sien Yang. No reason was given in the resignation by the ceo. However, his departure could be seen as timely, in fact a tad bit long overdue, given that ever since Singapore Telecom, a national company then, was privatised into SingTel. Lee has been at the helms for 12 years and throughout these years, leadership renewal has happened every year across all levels of SingTel's management. (You dont see regular SingTel classified ads on saturdays for nothin g.) Moreover, new leader could bring new perspectives to the company. Singtel has announced that it will embark on a capital reduction program where every 1 in 20 singtel shares will be cancelled and paid by singtel to shareholders at a price of 2.74. Now, i am no avid fan of fundamental analysis, in part bec my earlier losses in investing were all based on fundamental reports/analysis that has gone short of expectation, and also as emphasized in many of my posts, i believe fundamental news are released and used to support the technical movements of stocks which has already price in or unfolding what the news is about. If Singtel is going to pay 2.74 for every 1 share in 20 u hold, what happens when the date draws near on the closure of books for entitlement of the capital reduction?

g.) Moreover, new leader could bring new perspectives to the company. Singtel has announced that it will embark on a capital reduction program where every 1 in 20 singtel shares will be cancelled and paid by singtel to shareholders at a price of 2.74. Now, i am no avid fan of fundamental analysis, in part bec my earlier losses in investing were all based on fundamental reports/analysis that has gone short of expectation, and also as emphasized in many of my posts, i believe fundamental news are released and used to support the technical movements of stocks which has already price in or unfolding what the news is about. If Singtel is going to pay 2.74 for every 1 share in 20 u hold, what happens when the date draws near on the closure of books for entitlement of the capital reduction?

Technically, Singtel's 61.8% retracement mark from its high of 2.79 and low of 2.35 is 2.52, It has already touch it intraday today. From here, 2.56 would be another resistance to break before it can move to the 2.74 mark. Note from the chart that it has broken the downward resistance trendline and rsi is showing gd strength from its recent rally at the 2.40s region. Gd support at 2.46 for any adverse down movement.

g.) Moreover, new leader could bring new perspectives to the company. Singtel has announced that it will embark on a capital reduction program where every 1 in 20 singtel shares will be cancelled and paid by singtel to shareholders at a price of 2.74. Now, i am no avid fan of fundamental analysis, in part bec my earlier losses in investing were all based on fundamental reports/analysis that has gone short of expectation, and also as emphasized in many of my posts, i believe fundamental news are released and used to support the technical movements of stocks which has already price in or unfolding what the news is about. If Singtel is going to pay 2.74 for every 1 share in 20 u hold, what happens when the date draws near on the closure of books for entitlement of the capital reduction?

g.) Moreover, new leader could bring new perspectives to the company. Singtel has announced that it will embark on a capital reduction program where every 1 in 20 singtel shares will be cancelled and paid by singtel to shareholders at a price of 2.74. Now, i am no avid fan of fundamental analysis, in part bec my earlier losses in investing were all based on fundamental reports/analysis that has gone short of expectation, and also as emphasized in many of my posts, i believe fundamental news are released and used to support the technical movements of stocks which has already price in or unfolding what the news is about. If Singtel is going to pay 2.74 for every 1 share in 20 u hold, what happens when the date draws near on the closure of books for entitlement of the capital reduction?Technically, Singtel's 61.8% retracement mark from its high of 2.79 and low of 2.35 is 2.52, It has already touch it intraday today. From here, 2.56 would be another resistance to break before it can move to the 2.74 mark. Note from the chart that it has broken the downward resistance trendline and rsi is showing gd strength from its recent rally at the 2.40s region. Gd support at 2.46 for any adverse down movement.

Tuesday, July 25, 2006

Biosensors

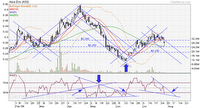

As requested by SH. Biosensors bottomed at .58 during May when it was involved in lawsuits over patent rights. Note that the 38.2% retracement mark from high of 1.30 and low of .58 is 1.02. In the meanwhile, it look set to test 1.02 with a strong closing today at its high of .955 high volume. Support at .93/.83. Sometimes we can use rsi to see when a stock is likely to reversed. I have marked out the blue arrows on the rsi chart with corresponding arrows on the price chart for your reference.

high of 1.30 and low of .58 is 1.02. In the meanwhile, it look set to test 1.02 with a strong closing today at its high of .955 high volume. Support at .93/.83. Sometimes we can use rsi to see when a stock is likely to reversed. I have marked out the blue arrows on the rsi chart with corresponding arrows on the price chart for your reference.

high of 1.30 and low of .58 is 1.02. In the meanwhile, it look set to test 1.02 with a strong closing today at its high of .955 high volume. Support at .93/.83. Sometimes we can use rsi to see when a stock is likely to reversed. I have marked out the blue arrows on the rsi chart with corresponding arrows on the price chart for your reference.

high of 1.30 and low of .58 is 1.02. In the meanwhile, it look set to test 1.02 with a strong closing today at its high of .955 high volume. Support at .93/.83. Sometimes we can use rsi to see when a stock is likely to reversed. I have marked out the blue arrows on the rsi chart with corresponding arrows on the price chart for your reference.Monday, July 24, 2006

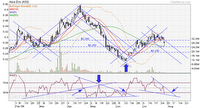

ASL Marine

As requested by SH. Technically, .62 remains a crucial point for it to stage a comeback, being the 61.8% retracement level from its high of .79 t o low of .51. Guided by the rising uptrend channel support and a rising rsi, .675 looks within reach, followed by .695. Note that a fall below .63 will be supported by .575.

o low of .51. Guided by the rising uptrend channel support and a rising rsi, .675 looks within reach, followed by .695. Note that a fall below .63 will be supported by .575.

o low of .51. Guided by the rising uptrend channel support and a rising rsi, .675 looks within reach, followed by .695. Note that a fall below .63 will be supported by .575.

o low of .51. Guided by the rising uptrend channel support and a rising rsi, .675 looks within reach, followed by .695. Note that a fall below .63 will be supported by .575. Olam

As requested by Shrek. From the chart, it looks like it has hit bottom at 1.18 when it touch a low of 1.18 and close at 1.24 today. Note that the 61.8% retracement mark from its hig h of 1.84 is at 1.43. Currently, as long as it can hold itself within the 1.20s region, it can test resistance at 1.30 and 1.43 soon. Caution that any close below 1.18, and we will be looking at sub $1 region again.

h of 1.84 is at 1.43. Currently, as long as it can hold itself within the 1.20s region, it can test resistance at 1.30 and 1.43 soon. Caution that any close below 1.18, and we will be looking at sub $1 region again.

h of 1.84 is at 1.43. Currently, as long as it can hold itself within the 1.20s region, it can test resistance at 1.30 and 1.43 soon. Caution that any close below 1.18, and we will be looking at sub $1 region again.

h of 1.84 is at 1.43. Currently, as long as it can hold itself within the 1.20s region, it can test resistance at 1.30 and 1.43 soon. Caution that any close below 1.18, and we will be looking at sub $1 region again. Sunday, July 23, 2006

Labroy Marine

As requested by TiTi Shawn. Kelive released a report on Labroy that it is 'sailing its way to blue chip status' and a target price of 2.38. While its music to the ears to investors of Labroy, we must not get too excited and carried away by the suggested target price. One can just look at Chartered and Utac for starters that more often than not, target prices are seldom met once they are quoted, especially if the gap difference between the current and the target price is  wide. It is more prudent that we look at what has happened and what is going on right now. We need not look furthur than to study the chart of stocks to confirm our analysis, be it fundamental or technical.

wide. It is more prudent that we look at what has happened and what is going on right now. We need not look furthur than to study the chart of stocks to confirm our analysis, be it fundamental or technical.

From its chart, Labroy is at the 1.40s region again. The resistance at 1.44/.46 is quite significant to break if labroy is to garner a move upwards. Note that 1.10 is the 61.8% retracement mark from its low of .79 & its all-time high of 1.64. This is another example why i believe trendlines and retracements always happen in patterns throughout a stock's lifecycle. For now, look to the breaking of 1.44 with volume as positive signs for labroy. If it weakens, gd point to enter would be 1.26.

wide. It is more prudent that we look at what has happened and what is going on right now. We need not look furthur than to study the chart of stocks to confirm our analysis, be it fundamental or technical.

wide. It is more prudent that we look at what has happened and what is going on right now. We need not look furthur than to study the chart of stocks to confirm our analysis, be it fundamental or technical.From its chart, Labroy is at the 1.40s region again. The resistance at 1.44/.46 is quite significant to break if labroy is to garner a move upwards. Note that 1.10 is the 61.8% retracement mark from its low of .79 & its all-time high of 1.64. This is another example why i believe trendlines and retracements always happen in patterns throughout a stock's lifecycle. For now, look to the breaking of 1.44 with volume as positive signs for labroy. If it weakens, gd point to enter would be 1.26.

SPC

As requested by TiTi Shawn. SPC has been trap in a range ever since the stock propelled itself above $4, between 4.60 & its all time high of $6. Recently fundamental news supporting its chart movements have been the less than expected find at Jeruk Oilfields. There are also arguments that increasing oil price actually depress refining margins for SPC. Whatever the case, SPC is still an oil-related company with stakes in refining and petroleum retail when it took ove r BP's chain of petroleum stations in Singapore. And oil has hit an all-time high of $78 per barrel, although it is mentioned that in real terms, the inflation-adjusted all-time high price of oil back during the gulf war in todays term is around $85. Importantly, we must differentiate the cause of high oil price between growth-induced or due to external geo-political events.

r BP's chain of petroleum stations in Singapore. And oil has hit an all-time high of $78 per barrel, although it is mentioned that in real terms, the inflation-adjusted all-time high price of oil back during the gulf war in todays term is around $85. Importantly, we must differentiate the cause of high oil price between growth-induced or due to external geo-political events.

Technically, SPC is back to its $5 support again, RSI trendlines suggest that it may test its recent high of 5.25 soon. From there on, it has to firmly consolidate at 5.25 before it can hit 5.75 again. On the down side, 4.88 should provide a gd suppport, failing which, the next crucial support will be at 4.60.

r BP's chain of petroleum stations in Singapore. And oil has hit an all-time high of $78 per barrel, although it is mentioned that in real terms, the inflation-adjusted all-time high price of oil back during the gulf war in todays term is around $85. Importantly, we must differentiate the cause of high oil price between growth-induced or due to external geo-political events.

r BP's chain of petroleum stations in Singapore. And oil has hit an all-time high of $78 per barrel, although it is mentioned that in real terms, the inflation-adjusted all-time high price of oil back during the gulf war in todays term is around $85. Importantly, we must differentiate the cause of high oil price between growth-induced or due to external geo-political events.Technically, SPC is back to its $5 support again, RSI trendlines suggest that it may test its recent high of 5.25 soon. From there on, it has to firmly consolidate at 5.25 before it can hit 5.75 again. On the down side, 4.88 should provide a gd suppport, failing which, the next crucial support will be at 4.60.

Saturday, July 22, 2006

Celestial Nutrifoods

As requested by mininvestor. By the looks of Celestial's trendlines, price is likely to be rangebound below 1.40 and supported by recent support at 1.30. Looking at the  RSI, Celestial may weaken to near 1.30 before staging a rally by mid of next trading week to attempt a breakthrough from 1.40 to test 1.60 again, its recent high. Take note that in the event of 1.30 support taken out, next significant support is at 1.10.

RSI, Celestial may weaken to near 1.30 before staging a rally by mid of next trading week to attempt a breakthrough from 1.40 to test 1.60 again, its recent high. Take note that in the event of 1.30 support taken out, next significant support is at 1.10.

RSI, Celestial may weaken to near 1.30 before staging a rally by mid of next trading week to attempt a breakthrough from 1.40 to test 1.60 again, its recent high. Take note that in the event of 1.30 support taken out, next significant support is at 1.10.

RSI, Celestial may weaken to near 1.30 before staging a rally by mid of next trading week to attempt a breakthrough from 1.40 to test 1.60 again, its recent high. Take note that in the event of 1.30 support taken out, next significant support is at 1.10. Friday, July 21, 2006

China Essence

As requested by sunningdale & victor. On the chart, it looks like a stock that everything is going its way. Closing at .625 today, it has broken out of the downward resistance line & is nestling above the support at .615. Observe th e RSI chart of China Essence, i have indicated blue arrows which shows its RSI breaking up from the downward resistance line and rising above the 30% downtrend support mark or what is commonly refered to as the oversold mark. With such a gd setup, together with higher than normal volume traded today, it looks set to test the .665 resistance very soon, if it can hold itself within the uptrend channel.

e RSI chart of China Essence, i have indicated blue arrows which shows its RSI breaking up from the downward resistance line and rising above the 30% downtrend support mark or what is commonly refered to as the oversold mark. With such a gd setup, together with higher than normal volume traded today, it looks set to test the .665 resistance very soon, if it can hold itself within the uptrend channel.

e RSI chart of China Essence, i have indicated blue arrows which shows its RSI breaking up from the downward resistance line and rising above the 30% downtrend support mark or what is commonly refered to as the oversold mark. With such a gd setup, together with higher than normal volume traded today, it looks set to test the .665 resistance very soon, if it can hold itself within the uptrend channel.

e RSI chart of China Essence, i have indicated blue arrows which shows its RSI breaking up from the downward resistance line and rising above the 30% downtrend support mark or what is commonly refered to as the oversold mark. With such a gd setup, together with higher than normal volume traded today, it looks set to test the .665 resistance very soon, if it can hold itself within the uptrend channel.I was told that a zaobao chartist has forecasted via the Elliot wave theory that our STi is on the last wave that may top out at 2420 level and promptly drop to below 2278, the last recent bottom. Yes, i have the same reaction as u do, shocked. Not by the magnitude of the fall forecasted, but by the pin-point accurate numbers and direction that was predicted.

I have to stressed once again that in trading or in life, no one absolutely knows for sure what will happen the next minute, not to mention the prediction which is definitely talking abt a period of at least 1 week. The movement in the stock market is the manifestation of the collective thinking of all the people participating within. As a person who analyse with TA, i feel that we must not fall into the trap of predicting what will happen. Instead, we should analyse what we should do when certain conditions happens, for eg, what do we do when a stock's price has broken through a resistance level, or what will be the support level when it didnt break and is now retracing back. This will be a more responsible way of using Technical Analysis and the way it is meant to be.

Thursday, July 20, 2006

Hyflux

The pride & joy of Singapore's world class water treatment industry. Landmark project is NEWater, Singapore first seawater desalination plant as the government seek to decrease our water-dependency from external soources for very strategic reasons.

It created a hype back then when Singapore is having some 'technical difficulity' over negotiating the renewal of our purchase of water source from malaysia. Probably to most Singaporean's pleasant surprise, the govt announced that we are ready to rely on our NEWater project (which was kept in secret for strategic reasons) as a new water source.

Water, indeed clean water, has been and will significantly be an important commodity in the future. China, in its preparation for Beijing 2008 Olympics, are expected to spend a fortune on cleaning up its backyard and front porch. This will significantly boost the biz of water/environmental treatment industries' pie that bio-treat,hyflux,darco,sino-environment, just to name a few, are fighting to get a slice of.

Recently, Hyflux entered the oil and solvent recycling business, after the acquisition of 51 percent equity in SK Oilchem Management Pte Ltd, (a Singapore-incorporated private exempt company licensed to collect and process new and used oil in Singapore).

Recently, Hyflux entered the oil and solvent recycling business, after the acquisition of 51 percent equity in SK Oilchem Management Pte Ltd, (a Singapore-incorporated private exempt company licensed to collect and process new and used oil in Singapore).

Hyflux will invest up to S$70 million in supplying a proprietary membrane plant for used oil recovery. Investment return is expected to exceed 20 percent. Hyflux really has to be commended for always seeking out venues to addon values to its current biz.

Technically, since hyflux doubled its price from $1.80 to $3.98 within 3 months last year, it has completed a double top and has never look back ever since, doing a one year long decline that knows no bottom. That is, until today, Hyflux has reached a critical point which will determine its revival. If it bounces up from 2.04 and exceed 2.20 in the coming weeks, a double bottom formation would give it momentum to seek out 2.38 and beyond. Will it once again regain its status as a market darling in the minds of investors? Hyflux - It's So Clear ..

Technically, since hyflux doubled its price from $1.80 to $3.98 within 3 months last year, it has completed a double top and has never look back ever since, doing a one year long decline that knows no bottom. That is, until today, Hyflux has reached a critical point which will determine its revival. If it bounces up from 2.04 and exceed 2.20 in the coming weeks, a double bottom formation would give it momentum to seek out 2.38 and beyond. Will it once again regain its status as a market darling in the minds of investors? Hyflux - It's So Clear ..

Tuesday, July 18, 2006

Starhub

Did u watch any matches during the World Cup? Chances are, u have watched a broadcast by Starhub's sports channel.. well, unless u r watching from malaysia/indonesia/p2p streaming of the matches. U might think that Starhub must be earning big bucks from its monopoly of the matches. Big bucks yes, but the main growth and revenue of Starhub does not come from its monopoly of cable tv but from its broadband biz.

Recently there are lots of 'news' that has serve to bring about fluctuation of Starhub's prices. Not long ago, on the day the Budget 2006 was ann ounced, starhub suffered a fall that brings it down to low of 1.91. It was the news of a nationwide broadband network that did it in. Not too long ago, the news of possible competition on its cable tv and epl matches also surfaced. To me, on hindsight, (back then i am still novice on TA), this kind of news only serve as an excuse for the biggies to play the stock to their advantage. I believe now that FA news serves to support TA movements opposite of what i used to think when i first bought stocks.

ounced, starhub suffered a fall that brings it down to low of 1.91. It was the news of a nationwide broadband network that did it in. Not too long ago, the news of possible competition on its cable tv and epl matches also surfaced. To me, on hindsight, (back then i am still novice on TA), this kind of news only serve as an excuse for the biggies to play the stock to their advantage. I believe now that FA news serves to support TA movements opposite of what i used to think when i first bought stocks.

Okie, back to analysing its chart movement, u might notice that last few days, Starhub was deliberately sold down to 2.06 recent low and rebounded today. Observe from the posted chart on its longterm support channel and u will begin to think the way i think soon enough. I leave it to u to analyse as i believe we learn best by doing things ourselves.

Support/resistance points at 2.14/2.17/2.23/2.29 . U might ask where do u enter and where do u exit the trade, well it all depends on your time frame of trade. U can go in tmr at 2.12 and exit next wk at 2.17. Or u might enter 2.12, it reverse from 2.17 and u cut ur gain at 2.14. All on time frame, just make sure u observe a gd cut loss/gain points which u are satisfied with.

Starhub looks like becoming the number 1 threat to SingTel after M1 reported lacklustre quarter earnings report. But could it be that regardless, there will still be a main winner? Check on who is the main shareholder of these 3 telcos and u will know the answer. Remember, the key is in the doing.

Recently there are lots of 'news' that has serve to bring about fluctuation of Starhub's prices. Not long ago, on the day the Budget 2006 was ann

ounced, starhub suffered a fall that brings it down to low of 1.91. It was the news of a nationwide broadband network that did it in. Not too long ago, the news of possible competition on its cable tv and epl matches also surfaced. To me, on hindsight, (back then i am still novice on TA), this kind of news only serve as an excuse for the biggies to play the stock to their advantage. I believe now that FA news serves to support TA movements opposite of what i used to think when i first bought stocks.

ounced, starhub suffered a fall that brings it down to low of 1.91. It was the news of a nationwide broadband network that did it in. Not too long ago, the news of possible competition on its cable tv and epl matches also surfaced. To me, on hindsight, (back then i am still novice on TA), this kind of news only serve as an excuse for the biggies to play the stock to their advantage. I believe now that FA news serves to support TA movements opposite of what i used to think when i first bought stocks.Okie, back to analysing its chart movement, u might notice that last few days, Starhub was deliberately sold down to 2.06 recent low and rebounded today. Observe from the posted chart on its longterm support channel and u will begin to think the way i think soon enough. I leave it to u to analyse as i believe we learn best by doing things ourselves.

Support/resistance points at 2.14/2.17/2.23/2.29 . U might ask where do u enter and where do u exit the trade, well it all depends on your time frame of trade. U can go in tmr at 2.12 and exit next wk at 2.17. Or u might enter 2.12, it reverse from 2.17 and u cut ur gain at 2.14. All on time frame, just make sure u observe a gd cut loss/gain points which u are satisfied with.

Starhub looks like becoming the number 1 threat to SingTel after M1 reported lacklustre quarter earnings report. But could it be that regardless, there will still be a main winner? Check on who is the main shareholder of these 3 telcos and u will know the answer. Remember, the key is in the doing.

"Give a man a chart and he will trade for a day, teach a man how to chart and he will trade for a lifetime." --ChartMan

Monday, July 17, 2006

MediaRing

As requested by Green: MediaRing. This stock is particularly susceptible to the ebbs and flows of fundamental news. Recently it was the proposed acquisition of PacNet that is creating the hype. It can be seen that MediaRing is quite desperate in trying to acquire PacNe t, and rightly so, given the synergy that it would benefit from PacNet's regional exposure in Internet communication services which would be an excellent platform for MediaRing to expand its VoIP biz. Whether or not it will succeed eventually is another matter.

t, and rightly so, given the synergy that it would benefit from PacNet's regional exposure in Internet communication services which would be an excellent platform for MediaRing to expand its VoIP biz. Whether or not it will succeed eventually is another matter.

At the moment, look to .305/.28/.265 for support and consolidation. Upwards resistance at .375 and .44, the 61.8% retracement from its recent low to its high of .53. Note that it is now in a tight downward trend channel in which the degree of change is sharp and fast. Vested traders have to be especially alert for sharp movements.

t, and rightly so, given the synergy that it would benefit from PacNet's regional exposure in Internet communication services which would be an excellent platform for MediaRing to expand its VoIP biz. Whether or not it will succeed eventually is another matter.

t, and rightly so, given the synergy that it would benefit from PacNet's regional exposure in Internet communication services which would be an excellent platform for MediaRing to expand its VoIP biz. Whether or not it will succeed eventually is another matter.At the moment, look to .305/.28/.265 for support and consolidation. Upwards resistance at .375 and .44, the 61.8% retracement from its recent low to its high of .53. Note that it is now in a tight downward trend channel in which the degree of change is sharp and fast. Vested traders have to be especially alert for sharp movements.

Sunday, July 16, 2006

Longcheer

Recently there are lawsuites filed on competitors of Longcheer in China on design patents infringements. Basically how these china handsets design firms work is that they imitate to a certain extent newly released handset designs by the big names like nokia, motorola, siemens etc and come out with a cheaper version th at resembles the originals. Generally, the consumer market segment which are price sensitive is the biggest everywhere, more so for China. And if one can obtain the latest nokia lookalike mobile design at a fraction of the cost, the answer is obvious.

at resembles the originals. Generally, the consumer market segment which are price sensitive is the biggest everywhere, more so for China. And if one can obtain the latest nokia lookalike mobile design at a fraction of the cost, the answer is obvious.

Technically, Longcheer has struggled to break through .865 in its recent recovery which will now be a tough resistance to overcome. Look to .70 for a crucial support that will determine if it consolidates and rebounds. If it does, there may yet be something to cheer about. The other alternative simply will not be pretty.

at resembles the originals. Generally, the consumer market segment which are price sensitive is the biggest everywhere, more so for China. And if one can obtain the latest nokia lookalike mobile design at a fraction of the cost, the answer is obvious.

at resembles the originals. Generally, the consumer market segment which are price sensitive is the biggest everywhere, more so for China. And if one can obtain the latest nokia lookalike mobile design at a fraction of the cost, the answer is obvious.Technically, Longcheer has struggled to break through .865 in its recent recovery which will now be a tough resistance to overcome. Look to .70 for a crucial support that will determine if it consolidates and rebounds. If it does, there may yet be something to cheer about. The other alternative simply will not be pretty.

Saturday, July 15, 2006

China Petrotech

As requested by Eka: China Petrotech. After rally to a high of .785, it has failed to consolidate at the .73 region, thus making a rapid test of the next suppo rt at .675 intraday. It closed at .69 for the day. Look for it to consolidate at the current region supported by .675, failing to do so, we would see it test .585 very soon.

rt at .675 intraday. It closed at .69 for the day. Look for it to consolidate at the current region supported by .675, failing to do so, we would see it test .585 very soon.

rt at .675 intraday. It closed at .69 for the day. Look for it to consolidate at the current region supported by .675, failing to do so, we would see it test .585 very soon.

rt at .675 intraday. It closed at .69 for the day. Look for it to consolidate at the current region supported by .675, failing to do so, we would see it test .585 very soon. Note that the company is an IT solutions provided to the oil and gas industries, however its main operations is in China, hence it is not spared in the latest declince of china stocks.

Friday, July 14, 2006

System Access

As requested by victor: System Access. It is rare that a stock that is not affected by a broad base decline of the market, much less, breaking out of an all time high of 0.245 to c lose at 0.26. It is now in free space, uncharted territory, however, is likely to find itself consolidating at the top bordered by the downward resistance line and supported at 0.245. Next support at 0.22.

lose at 0.26. It is now in free space, uncharted territory, however, is likely to find itself consolidating at the top bordered by the downward resistance line and supported at 0.245. Next support at 0.22.

lose at 0.26. It is now in free space, uncharted territory, however, is likely to find itself consolidating at the top bordered by the downward resistance line and supported at 0.245. Next support at 0.22.

lose at 0.26. It is now in free space, uncharted territory, however, is likely to find itself consolidating at the top bordered by the downward resistance line and supported at 0.245. Next support at 0.22. Asiapharm

As requested by sunningdale: Asiapharm. It has failed to held firm at 0.77, the 61.8% retracement mark, and when this mark was broken, the carpet simply gave wa y beneath. Most importantly, today it broke another support at 0.72. Look to 0.68 for it to stage a rebound, failing to do so would see it touch 0.625 again.

y beneath. Most importantly, today it broke another support at 0.72. Look to 0.68 for it to stage a rebound, failing to do so would see it touch 0.625 again.

y beneath. Most importantly, today it broke another support at 0.72. Look to 0.68 for it to stage a rebound, failing to do so would see it touch 0.625 again.

y beneath. Most importantly, today it broke another support at 0.72. Look to 0.68 for it to stage a rebound, failing to do so would see it touch 0.625 again. Thursday, July 13, 2006

China Milk

Due to a overwhelming strong mandate of 60% in the polls for the weekend stock to be charted, i hv decided to give an early progress bonus to the voters for China Milk. (u dont hv to wait til weekend to see the chart) ;)

When China Milk made its debut in our casino, there is rumour of it bei ng played by the syndicates as we struggled to catch our breath when it rose to an all time high of 1.51 less than 2 month of its listing. Since then, it has made a double top and coupled with the june correction, it has amazingly retraced all its gains and touch its ipo opening price of 0.83 again. One can only assume that the rumored syndicates has since distributed their holdings to unwary investors.

ng played by the syndicates as we struggled to catch our breath when it rose to an all time high of 1.51 less than 2 month of its listing. Since then, it has made a double top and coupled with the june correction, it has amazingly retraced all its gains and touch its ipo opening price of 0.83 again. One can only assume that the rumored syndicates has since distributed their holdings to unwary investors.

When China Milk made its debut in our casino, there is rumour of it bei

ng played by the syndicates as we struggled to catch our breath when it rose to an all time high of 1.51 less than 2 month of its listing. Since then, it has made a double top and coupled with the june correction, it has amazingly retraced all its gains and touch its ipo opening price of 0.83 again. One can only assume that the rumored syndicates has since distributed their holdings to unwary investors.

ng played by the syndicates as we struggled to catch our breath when it rose to an all time high of 1.51 less than 2 month of its listing. Since then, it has made a double top and coupled with the june correction, it has amazingly retraced all its gains and touch its ipo opening price of 0.83 again. One can only assume that the rumored syndicates has since distributed their holdings to unwary investors. Today's closing price of 0.985 see it broke through its support line/channel at 0.995. If it does not hug back this support line swiftly in the next few days, we could see it retraced back to 0.945. Positive sign would be a close above 1.02, to retest the 61.8% retracement mark at 1.09. By then, its momentum would hv been enough to send it back to 1.24 again, the 38.2% retracement level. For a company that profits handsomely from pedigree bull semen, it has really struck the right chord in the minds of investors.

CapitaLand

As requested by Green: CapitaLand. It was one of the very first stock that i bought when i entered the casino(stock market) years ago. I still remember the price i bought was 1.22. I bought Comfortdelgro as well at 1.24. Now, Comfortdelgro is 1.50+ while Capit aLand? Makes you wish to dump every penny u have on it isnt it while its still in the $1 region. But we never know, u say. Well, not if u didnt study/analysis its chart formation.

aLand? Makes you wish to dump every penny u have on it isnt it while its still in the $1 region. But we never know, u say. Well, not if u didnt study/analysis its chart formation.

Right now, it has reach a crucial support point at 4.42. Look to it for CapitaLand to maintain its uptrend momentum. If it does hold strong here, the uptrend channel will lead it to test 4.70 again. Otherwise, look to 4.26 & 4.12 for support. Worst case scenario is for it corr ect back all its recent gains and test its near-term bottom at 3.82 again. A analyst from UOB recently commented in his report that he recommends a sell at current 4.40-4.50 region and he expects it to retrace back to the 4.00 region again. I do not know how he come out with such a prediction, by fundamental analysis or technical. If by technical, my views is that technical analysis can and only will show us where the stocks are at any particular point in the past and what we should do when certain conditions are met. If its based on fundamental, we have to be critical of the agenda behind.

ect back all its recent gains and test its near-term bottom at 3.82 again. A analyst from UOB recently commented in his report that he recommends a sell at current 4.40-4.50 region and he expects it to retrace back to the 4.00 region again. I do not know how he come out with such a prediction, by fundamental analysis or technical. If by technical, my views is that technical analysis can and only will show us where the stocks are at any particular point in the past and what we should do when certain conditions are met. If its based on fundamental, we have to be critical of the agenda behind.

aLand? Makes you wish to dump every penny u have on it isnt it while its still in the $1 region. But we never know, u say. Well, not if u didnt study/analysis its chart formation.

aLand? Makes you wish to dump every penny u have on it isnt it while its still in the $1 region. But we never know, u say. Well, not if u didnt study/analysis its chart formation.Right now, it has reach a crucial support point at 4.42. Look to it for CapitaLand to maintain its uptrend momentum. If it does hold strong here, the uptrend channel will lead it to test 4.70 again. Otherwise, look to 4.26 & 4.12 for support. Worst case scenario is for it corr

ect back all its recent gains and test its near-term bottom at 3.82 again. A analyst from UOB recently commented in his report that he recommends a sell at current 4.40-4.50 region and he expects it to retrace back to the 4.00 region again. I do not know how he come out with such a prediction, by fundamental analysis or technical. If by technical, my views is that technical analysis can and only will show us where the stocks are at any particular point in the past and what we should do when certain conditions are met. If its based on fundamental, we have to be critical of the agenda behind.

ect back all its recent gains and test its near-term bottom at 3.82 again. A analyst from UOB recently commented in his report that he recommends a sell at current 4.40-4.50 region and he expects it to retrace back to the 4.00 region again. I do not know how he come out with such a prediction, by fundamental analysis or technical. If by technical, my views is that technical analysis can and only will show us where the stocks are at any particular point in the past and what we should do when certain conditions are met. If its based on fundamental, we have to be critical of the agenda behind.Wednesday, July 12, 2006

Ezyhealth

Specially for Blitz: Ezyhealth. In danger comes opportunity. Ezyhealth brok e down from 2 crucial points of 0.17 the support of the previous uptrend channel and 0.16 its near-term supportline. 0.125 looks gd for it to stage a rebound. Watchout for 'doji' formations like '+' or better still dragonfly candlesticks like 'T' , followed by white candles for confirmation of reversal.

e down from 2 crucial points of 0.17 the support of the previous uptrend channel and 0.16 its near-term supportline. 0.125 looks gd for it to stage a rebound. Watchout for 'doji' formations like '+' or better still dragonfly candlesticks like 'T' , followed by white candles for confirmation of reversal.

e down from 2 crucial points of 0.17 the support of the previous uptrend channel and 0.16 its near-term supportline. 0.125 looks gd for it to stage a rebound. Watchout for 'doji' formations like '+' or better still dragonfly candlesticks like 'T' , followed by white candles for confirmation of reversal.

e down from 2 crucial points of 0.17 the support of the previous uptrend channel and 0.16 its near-term supportline. 0.125 looks gd for it to stage a rebound. Watchout for 'doji' formations like '+' or better still dragonfly candlesticks like 'T' , followed by white candles for confirmation of reversal. Hongguo

They say women's money is the easiest to earn. Well, ask Hongguo and you will know. This ladies fashion footwear manufacturer is no less of a wonder china stock. After a double top and breakdown of its main uptrend channel in may'06, it started a downtrend that lasted a month. In end june'06, it brokeout of the downtrend channel and looked set to resume its previous upwards  momentum. At the moment, 0.73 will be a signifant resistance. It is less likely for it to penetrate convincingly at the moment. It looks more likely to consolidate along the downward resistance trendline and supported by 0.625 before gathering enough momentum to retest 0.73 and breakthrough its all-time high of 0.75.

momentum. At the moment, 0.73 will be a signifant resistance. It is less likely for it to penetrate convincingly at the moment. It looks more likely to consolidate along the downward resistance trendline and supported by 0.625 before gathering enough momentum to retest 0.73 and breakthrough its all-time high of 0.75.

momentum. At the moment, 0.73 will be a signifant resistance. It is less likely for it to penetrate convincingly at the moment. It looks more likely to consolidate along the downward resistance trendline and supported by 0.625 before gathering enough momentum to retest 0.73 and breakthrough its all-time high of 0.75.

momentum. At the moment, 0.73 will be a signifant resistance. It is less likely for it to penetrate convincingly at the moment. It looks more likely to consolidate along the downward resistance trendline and supported by 0.625 before gathering enough momentum to retest 0.73 and breakthrough its all-time high of 0.75. GES

As requested by victor, GES has touched an all-time high of 1.15 and back down.  As i was commenting a few days ago on the chat box, it will retraced to the 38.2% mark from its high to rest on 1.03. It is vital that GES consolidates at 1.03 in order to attempt a test on its high again in the short-run. Otherwise, the next crucial support points will be 1.01 and 0.97 failing which, the uptrend will no longer be valid.

As i was commenting a few days ago on the chat box, it will retraced to the 38.2% mark from its high to rest on 1.03. It is vital that GES consolidates at 1.03 in order to attempt a test on its high again in the short-run. Otherwise, the next crucial support points will be 1.01 and 0.97 failing which, the uptrend will no longer be valid.

As i was commenting a few days ago on the chat box, it will retraced to the 38.2% mark from its high to rest on 1.03. It is vital that GES consolidates at 1.03 in order to attempt a test on its high again in the short-run. Otherwise, the next crucial support points will be 1.01 and 0.97 failing which, the uptrend will no longer be valid.

As i was commenting a few days ago on the chat box, it will retraced to the 38.2% mark from its high to rest on 1.03. It is vital that GES consolidates at 1.03 in order to attempt a test on its high again in the short-run. Otherwise, the next crucial support points will be 1.01 and 0.97 failing which, the uptrend will no longer be valid. Tuesday, July 11, 2006

STi

As requested by Bion, we have here our STi. Since its all time high of 2666 to its recent low of 2280, it has retraced back 38.2% from the fall at 2424. To maintain its upwards

recovery, it has to consolidate at at this crucial point for the weeks ahead. Important resistances to breakout from are 2450 & 2490, support points to hold up the index are 2380 & 2350. Now that the World Cup(which are blamed for the june's correction) are over, and the earning reports season are back, we can only hope that fund managers, and short-term wise, the hedge fund managers, whom are said to have exited much of their holdings during the correction, can sta

recovery, it has to consolidate at at this crucial point for the weeks ahead. Important resistances to breakout from are 2450 & 2490, support points to hold up the index are 2380 & 2350. Now that the World Cup(which are blamed for the june's correction) are over, and the earning reports season are back, we can only hope that fund managers, and short-term wise, the hedge fund managers, whom are said to have exited much of their holdings during the correction, can sta rt to load up their portfolios. And of course, for some pleasant surprises on the upcoming earnings reports. Perhaps the following report and Mr. Lee, could spur some enthusiam/confidence to investors/traders/funds/uncles/aunties/you and me. ;)

rt to load up their portfolios. And of course, for some pleasant surprises on the upcoming earnings reports. Perhaps the following report and Mr. Lee, could spur some enthusiam/confidence to investors/traders/funds/uncles/aunties/you and me. ;)" SINGAPORE - Government of Singapore Investment Corp, which manages Singapore's reserves of more than US$100 billion, said on Tuesday it would raise its investments in emerging markets in Asia, Europe and the Middle East"

"Speaking at a dinner to mark GIC's anniversary, Mr Lee, said the average annual rate of return was 8.2 per cent in Singapore dollar terms. The return over global inflation was 5.3 per cent a year."

Monday, July 10, 2006

Cosco

Since last year, Cosco has been undergoing restructuring to re-position itself as a core ship-repair business. It has even enter the lucrative rig-building arena, albeit m ore is needed for Cosco to develop itself in this altogether new field although Semb Marine having a stake in Cosco Shipyards is able to aid in one way or another. A perfect strategic alliance.

ore is needed for Cosco to develop itself in this altogether new field although Semb Marine having a stake in Cosco Shipyards is able to aid in one way or another. A perfect strategic alliance.

It would not be overstating to say that Cosco is a no-brainer stock to hold, as longterm investors see their holdings double/triple/quadruple in value. Such is the strong uptrend of Cosco. In the aftermath of June'06 correction, it has taken a dip below it main long uptrend channel. Now, it is back on track to continue its upwards momentum. Expect heavy selling at 1.32. Positive sign will be a close above 1.35 with big volume. Once that is achieved, its a matter of time before it h its 1.40 an

its 1.40 an d retest its all-time high again. Question is, will you be there when that happens?

d retest its all-time high again. Question is, will you be there when that happens?

ore is needed for Cosco to develop itself in this altogether new field although Semb Marine having a stake in Cosco Shipyards is able to aid in one way or another. A perfect strategic alliance.

ore is needed for Cosco to develop itself in this altogether new field although Semb Marine having a stake in Cosco Shipyards is able to aid in one way or another. A perfect strategic alliance.It would not be overstating to say that Cosco is a no-brainer stock to hold, as longterm investors see their holdings double/triple/quadruple in value. Such is the strong uptrend of Cosco. In the aftermath of June'06 correction, it has taken a dip below it main long uptrend channel. Now, it is back on track to continue its upwards momentum. Expect heavy selling at 1.32. Positive sign will be a close above 1.35 with big volume. Once that is achieved, its a matter of time before it h

its 1.40 an

its 1.40 an d retest its all-time high again. Question is, will you be there when that happens?

d retest its all-time high again. Question is, will you be there when that happens? Sunday, July 09, 2006

Federal

Another oil & gas marvel requested by baby. From a low of 0.20 to its high of 0.76 on 9th Feb'06, it has retraced 61.8% of its gains at 0.415 which will now be a gd support. Currently it is facing resistance at 0.545, a 38.2% retracement from its all time high. Likely to remain rangebound between 0.48 & 0.545 until high volume breakout from either point. Higher chance of breaking up, as abnormally high volume observed on days with higher close. Not surprising for a stock which doubles it price within one month.

Another oil & gas marvel requested by baby. From a low of 0.20 to its high of 0.76 on 9th Feb'06, it has retraced 61.8% of its gains at 0.415 which will now be a gd support. Currently it is facing resistance at 0.545, a 38.2% retracement from its all time high. Likely to remain rangebound between 0.48 & 0.545 until high volume breakout from either point. Higher chance of breaking up, as abnormally high volume observed on days with higher close. Not surprising for a stock which doubles it price within one month.

KS Energy

One of the favourite oil & gas stocks, KS Energy is known for its explosive rise and subsequent very gradual decline. It reached its all time high in aug'05  with a 2 month explosive rally and subsequently took the next 5 months to retraced 61.8% of its gains. After touching its long term uptrend support in jan'06, it began its rally again which lasted 4 months to reach another all time high. This time it took 3 subsequent months to retraced 61.8% of its gains at 1.98 which will now be a good support. On 7th July'06, it broke out

with a 2 month explosive rally and subsequently took the next 5 months to retraced 61.8% of its gains. After touching its long term uptrend support in jan'06, it began its rally again which lasted 4 months to reach another all time high. This time it took 3 subsequent months to retraced 61.8% of its gains at 1.98 which will now be a good support. On 7th July'06, it broke out with high volume to reach a high of 2.15. It is now in a new uptrend channel which may led it back to the 38.2% retracement from its high at 2.28. Positive sign will be a close above 2.16 with high volume. At the moment, it is likely to pullback, supported by its new uptrend channel's support line.

with high volume to reach a high of 2.15. It is now in a new uptrend channel which may led it back to the 38.2% retracement from its high at 2.28. Positive sign will be a close above 2.16 with high volume. At the moment, it is likely to pullback, supported by its new uptrend channel's support line.

with a 2 month explosive rally and subsequently took the next 5 months to retraced 61.8% of its gains. After touching its long term uptrend support in jan'06, it began its rally again which lasted 4 months to reach another all time high. This time it took 3 subsequent months to retraced 61.8% of its gains at 1.98 which will now be a good support. On 7th July'06, it broke out

with a 2 month explosive rally and subsequently took the next 5 months to retraced 61.8% of its gains. After touching its long term uptrend support in jan'06, it began its rally again which lasted 4 months to reach another all time high. This time it took 3 subsequent months to retraced 61.8% of its gains at 1.98 which will now be a good support. On 7th July'06, it broke out with high volume to reach a high of 2.15. It is now in a new uptrend channel which may led it back to the 38.2% retracement from its high at 2.28. Positive sign will be a close above 2.16 with high volume. At the moment, it is likely to pullback, supported by its new uptrend channel's support line.

with high volume to reach a high of 2.15. It is now in a new uptrend channel which may led it back to the 38.2% retracement from its high at 2.28. Positive sign will be a close above 2.16 with high volume. At the moment, it is likely to pullback, supported by its new uptrend channel's support line. Saturday, July 08, 2006

Celestial Nutrifoods

One of the hottest china stocks in town. After the correction in May as with many stocks, Celestial is back on track onto its relentless upwards momentum. It has retraced and surpassed the 38.2% mark from its high of 2.10 on 15th May to a low of 1.03 on 8th June, at 1.41 with a high volume of 28mil on 4th July. By its current momentum, it looked set to touch the 61.8% retracement at 1.69 soon, barring its current upwards trend channel is not broken.

One of the hottest china stocks in town. After the correction in May as with many stocks, Celestial is back on track onto its relentless upwards momentum. It has retraced and surpassed the 38.2% mark from its high of 2.10 on 15th May to a low of 1.03 on 8th June, at 1.41 with a high volume of 28mil on 4th July. By its current momentum, it looked set to touch the 61.8% retracement at 1.69 soon, barring its current upwards trend channel is not broken.Friday, July 07, 2006

UTAC

As requested by Old Chunky: UTAC. 0.81 proves to be a strong resistance. But as in the same nature, it will be a strong support once it is taken out convincingly. For it to maintain its course in its current uptrend channel, it has to close above 0.79. Positive signs will be a close above 0.81 with high volume. Fibo 38.2% retracement at 0.87, a near term target to reach for.

As requested by Old Chunky: UTAC. 0.81 proves to be a strong resistance. But as in the same nature, it will be a strong support once it is taken out convincingly. For it to maintain its course in its current uptrend channel, it has to close above 0.79. Positive signs will be a close above 0.81 with high volume. Fibo 38.2% retracement at 0.87, a near term target to reach for. Jurong Tech

As requested by samchng: Strong support at 0.965. Fibo retracement 23.6% coincide with support-turned resistance 1.08, 38.2% at 1.18. At the moment, the stock is still within a very broad longterm downtrend. But there is signs of bottoming and reversing. Watchout for closing above 1.03 and then 1.08 for signs of new uptrending.

As requested by samchng: Strong support at 0.965. Fibo retracement 23.6% coincide with support-turned resistance 1.08, 38.2% at 1.18. At the moment, the stock is still within a very broad longterm downtrend. But there is signs of bottoming and reversing. Watchout for closing above 1.03 and then 1.08 for signs of new uptrending.Reminiscences of a Daytrader.

Hello fellow investors/traders/punters/uncles & aunties, this blog is created on this day for you. Why do i say that? Well, it is likely the case that you do not have the necessary software/hardware or even inclination to do charting before you plunge your hard-earned $ into the world's biggest ever created casino, the stockmarket. So, it is my desire to provide this service to all of us and in so doing, all of us will learn in the process of dabbling in the stock market.

Now, a little background on myself; I have been investing/trading in the local singapore market for the past 4 years. During this time, i have won big, and lost big, riding the wave of the oil & gas euphoria as well as losing on the fraud of ChinaAvOil and Cityraya. Yes, i have been through it all. I believe all of us are still in the search for a way to understand and interpret the seemingly random market movements. Personally i have read countless books on trading & investing and still is unsatisfied with what i can get out of them.

Finally, slowly but surely, i discovered that technical analysis is the better way to interpret these movement. In fact i would go so far as to say that fundamental news are used to support the movements in the market and not the other way round as what all of us are led to believe when we first entered the casino. In life, there are many things which are beyond our knowledge and understanding. So from this day onwards, i will begin to unravel the order within the chaos of the singapore stock market. Lets learn & earn together!

Last but not least, i would like to take this opportunity to dedicate this blog to Kaze of Chartpower. It is her who inspired me and i believe many others to seek out the answers to many of our questions on charting. Come back, Kaze.

Now, a little background on myself; I have been investing/trading in the local singapore market for the past 4 years. During this time, i have won big, and lost big, riding the wave of the oil & gas euphoria as well as losing on the fraud of ChinaAvOil and Cityraya. Yes, i have been through it all. I believe all of us are still in the search for a way to understand and interpret the seemingly random market movements. Personally i have read countless books on trading & investing and still is unsatisfied with what i can get out of them.

Finally, slowly but surely, i discovered that technical analysis is the better way to interpret these movement. In fact i would go so far as to say that fundamental news are used to support the movements in the market and not the other way round as what all of us are led to believe when we first entered the casino. In life, there are many things which are beyond our knowledge and understanding. So from this day onwards, i will begin to unravel the order within the chaos of the singapore stock market. Lets learn & earn together!

Last but not least, i would like to take this opportunity to dedicate this blog to Kaze of Chartpower. It is her who inspired me and i believe many others to seek out the answers to many of our questions on charting. Come back, Kaze.

Subscribe to:

Posts (Atom)