* The market is topping out.

* The market is oversold (or overbought).

* We are in a third wave.

* This is a short covering rally.

* One should never take more than a $500 loss.

* Never risk over 2 percent of your total equity on one trade.

* The seasonal activity will take this market higher.

All of these statements are totally ungrounded assessments and do not, in any accurate way, describe the market or market behavior. Ungrounded assessments create chronic losers. If you are a losing trader, I can assure you that one of the principal causes is that you are making decisions based on ungrounded assessments. Grounded assessments are real, verifiable, unambiguous, and accurate, and they come directly from the market itself. The material and indicators in Chapters Three through Ten include only grounded market generated assessments. Basically, all of our observations (assessments) go through a part of the brain(the reticular activating system, or RAS), which acts as an analyzer and gives us only the information that passes our filters (what we want to hear). In no way does it give us a true take on reality or on what is really out there. A camera does not have an RAS to filter its incoming information. It just records what is present in a certain vibratory octave. It will take a picture of a yellow vehicle with black writing on it, and that is what you get. We, however, identify the yellow vehicle as a school bus and immediately all of our prejudices and preconceived notions jump to the forefront rather than seeing what is actually there. We think about slowing down, not passing, and watching carefully for small children.

Our actions are not based on grounded assessments but on our history(belief system) with that particular concept. It is said that generals always fight the previous war rather than the one they are in. We traders generally trade our last mistake rather than what is happening in the current market. In other words, we set up our own prejudices based on past experiences, and any incoming information will be filtered to make sure that it does not contradict our belief systems. If reality does conflict with our belief systems, we will deny reality and distort incoming information to keep our unquestioned beliefs intact.

No wonder we perform so miserably in the market even though we may have been extremely successful in other professions or businesses. In the market, you either confront reality or you create losses. If we want to climb off this ladder to distress, we must confront what is really going on in the market rather than our ideas about it. I will briefly review here what is going on. I refer the reader to my previous book for a more complete description. The primary purpose of the market is to find immediately the exact price where there is an:

Equal disagreement on value and an agreement on price

The last time you bought a car, you and the dealer or person you bought it from had to agree on a price. Before the price could be fixed, you had to negotiate a disagreement on value. Without a disagreement on value, there is no market. You wanted the car more than you wanted the money you were ready to spend to purchase it. The person you bought it from wanted your money more than the car. All free market transactions must have these two elements. When they are present, you have created a commodity or stock market. When someone tells you the market is "oversold," it simply means that the market went lower than the person thought it would. It says nothing about the market. I respect the analysts' right to use this or any other term, but there just isn't any such condition as oversold or overbought. The primary function of any market or exchange is to make sure that this condition does not exist, even for a second. Whenever you read that there is a 60 percent bullishness in bonds, it only means all the bears haven't been surveyed. If the market were 50.01 percent bullish, the price would have already gone up. Here is the truest statement I can make about the market:

The market is where it is because that is where it is supposed to be, and it is supposed to be there because that is where it is.

Think about this for a moment. Once you grasp this concept, you will:

1. Know more about the market than 90 percent of those who have money invested in it.

2. You will have started down a yellow brick road to more profits.

The market is where it is because, at this point in time, this is its fair value simply because you have an equal number of contracts buying and selling at that price. Don't get me wrong: I'm not trying to convince you of anything. I don't have even a thimbleful of missionary bloodin my veins. If you really believe there is such a thing as bullish/bearish consensus and/oroversold/overbought conditions, be my guest. Would you also like a spare tooth to put under your pillow tonight for the tooth fairy? It is time to get serious or get ripped off. "The marketis . . ." definition above is a true, brief, and accurate description of what is happening everytime a commodity or a share of stock is sold or bought. We don't need all the millions of ungrounded assessments (opinions) floating around. In our private tutorials, we strongly suggest that there is no need to seek out any source for information other than the market-generated information. Reading the Wall Street Journal, Barron's, or Investors Daily; subscribing to advisers' newsletters or hotlines; or tuning in to financial TV or radio is more destructive to your financial health than smoking is destructive to your physical health.

(Excerpt from New Trading Dimension: How to Profit from Chaos in Stocks)

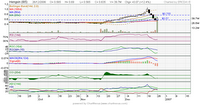

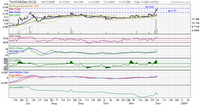

NB: Tried as i might, i couldnt post my chart for Techoil&Gas. I will verbally describe the chart here instead: Techoil 's chart shows retracement from breakout of .75 region , as long as price can maintain above this level, good chance of retesting res at .815 .