To say that trading is simple, easy, and profitable is incredulous to most traders and absolutely absurd to others. Almost all traders experience a great deal of doubt. In this section, we are going to look at ways to rise above the clouds of doubt. This will ultimately happen only after enough experience in using my trading techniques to prove their overall profitability.

The key to rising above doubt is to again realize what game we are playing. The game is trading our own belief systems. If we want to change our results, we must change our beliefs. Beliefs are what we "know" to be true. We almost never question our deep beliefs, but that is exactly what a losing trader must do: question personal beliefs not only about the market but, even more, about themselves.

Very few traders know why they trade, much less how they trade. We all can spout our superficial reasons: to make money fast, to enjoy competing with other traders, to gain the prestige of being able to say "I am a trader," and so on. In your last trade, did you lose because you couldn't see the market going the other way, or because of a deep, unexamined belief that you shouldn't get rich that easily? If the latter, it's time to free yourself from some old beliefs.

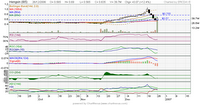

Hongguo ~ As posted previously, conform to expectation. Target res .97

Hengxin ~ Reversal, supp .57 , res .755

Mapletree Log ~ Retracement from breakout, supp 1.06 , res 1.18

Rotary ~ Uncharted territory, supp .66/.60/.525

Your next task is to release, get rid of, or, at the very least, become aware of these beliefs.The best method is to examine the difference between process and content. Classical sciences have always tended to deal with content. "My head, it hurts" is an example of how the classical sciences divide everything into three parts:

1. The observer.

2. The thing being observed.

3. The process of observing.

Modern sciences (relativity, quantum physics, and the Science of Chaos) do not create or condone this separation. A quantum scientist would report, "I am in the process of headaching myself "- much more accurate description. Modern science does not believe there is any such thing as nouns. Everything is energy and all energy is process. Buck minster Fuller titled his autobiography I Am A Verb. This distinction between process and content will become very important to our proficiency at dealing with the market. In general, we are educated to be goal-directed, making what isn't more important than what is. We make lists of our goals, plan them out, and then neglect the present and live, in our head, in the future. The problem with living in the land of goals rather than the land of now is that when we center our attention on the future, we cannot concentrate on or even accurately observe what is happening now. We can't dance well while thinking about how we are dancing.

We can't trade well when we're planning what we are going to do (trade) tomorrow. Living in the now is a necessity to good trading. Living in the now is another way of saying: Pay attention to process rather than future goals or desires. One way of living in the now is to make sure that all our observations (or as many as possible) are based on "grounded versus ungrounded" assessments. Again, this is not an economic, fundamental, technical, or mechanical approach. It is a behavioral approach using only market-generated information.

(Excerpts from book: New Trading Dimension, How to Profit from Chaos in Stocks)

No comments:

Post a Comment